Both stocks and cryptocurrency are kinds of investments. One can be considered as a traditional form of investment whiles the other; crypto is a modern investment that is increasing its value. After the pandemic due to Covid 19, it has been observed that Bitcoin is one of the leading digital coins. It has been ranking at the top with the high value of the coin. On contrary, stocks have seen the minimum improvement in stock investment. After the pandemic both the sectors are escalating together.

It is true that investors prefer stock investment. As they are aware of the pros and cons of the investments, their trust and dependence on the platform are high. Bitcoin or blockchain is a new technology, therefore few investors are able to implement their knowledge to earn high returns. Covid 19 has brought a financial crisis that has negatively impacted stocks.

As blockchain technology is a digital platform it has driven opportunities for peer-to-peer transactions. It has increased the value in spite of the volatile market strategy.

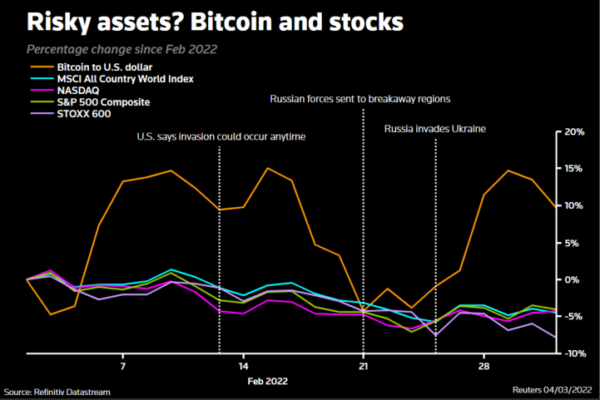

Stocks and crypto are running together

Crypto has a negative influence on the investors, which has been discouraging them to invest. The volatile market of blockchain puts the investment in danger if investors are not aware of the market conditions. Stocks being an older platform with less volatility have never lost their influence and importance in engaging investors.

Control of market, crypto

Bitcoins are controlled by the whales or the old investors who own bitcoin. If the availability of the crypto coins decreases, there is a demand. The prices or values increase. Therefore, the market is controlled by investors. They can decrease and increase the value of bitcoin. It is against the growth of the market.

The stock market is independent

But the stock market works on different platforms. Investors invest in the company, and as the prices of the products changes, they can buy or sell their shares. The market is independent which shows a long-term benefit on investments.

Economic condition is responsible for the escalation

During the lockdown, the value of the crypto market increased. It led to parallel function of the markets, at a time after the pandemic, the digital currency is competing with the stocks and share markets. Worldwide, when the economic condition faces hardships, investors are earning high profits on cryptocurrency.

Above all the monetary policy is another essential factor that has escalated demand for both together. The decrease in interest on bonds, and shares leads to reduce the production of market functions. Investors lose their interest to invest when the economy undergoes inflation. The drawbacks and benefits together have provided their roles in developing a beneficial market for investors.

Traditional share and stock investors are slowly investing in cryptocurrencies. The low returns from the stocks have forced them to move to digital platforms. Above all, acceptance of the blockchain in financial institutions has made transactions smoother and easier for investors. Peer-to-peer technology and easy transaction from any part of the world has escalated the demand similar to stock and share markets making stocks and crypto to work equally for investors.