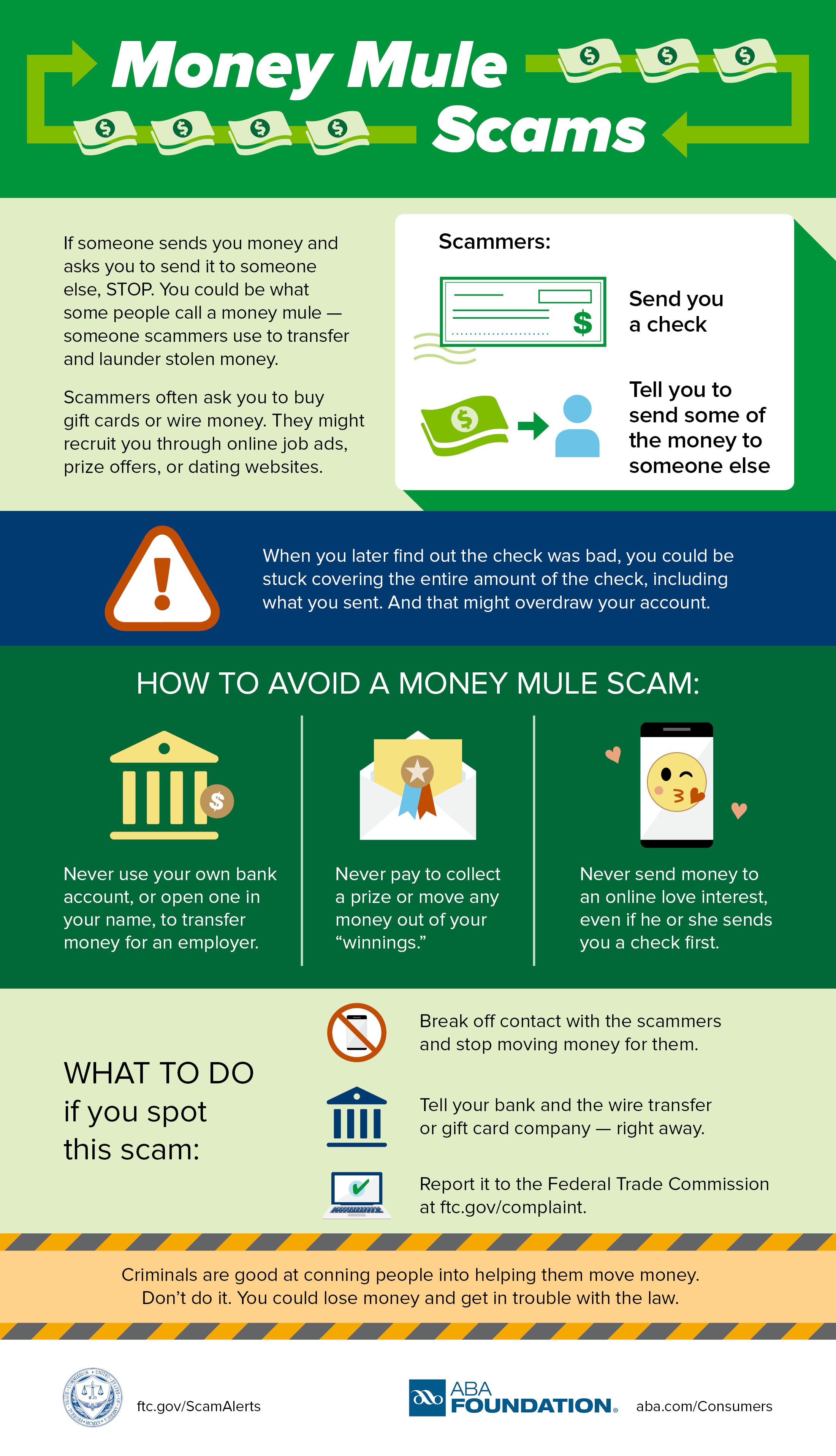

Cyber attacks are the biggest concern, after the increasing scams, and spam has diversified to simple but major financial losses. With the ease of paying online, different payment applications, and also with the various cash applications life has become easier. Customers can send money through the application within a few seconds.

But with ease, it has been also difficult to understand the arising issues, scams, and spams with the advantages. Slowly users are screwed up by the arising problems of cash applications online. As the application provides convenience, it has developed trust among the users. A blind trust has grown, it is helping to provide scopes for phishing and scams.

Cybercrimes have eased their pathways to reach the maximum targets. It has been possible the customers using cash applications unaware of the different indulgence of phishing methods. It can be SMS, URL links attached, or emails.

Entering the website or taking action according to the SMS. The action to call can put a user into the trap of phishing. It becomes easy for hackers to track the information of cash application users.

When users are using the Cash application, they may be receiving several messages a day. The disadvantage of the transaction taking place through the applications cannot be tracked. There are sometimes missing characters in the invoices. Sometimes codes are not possible for a person or user to track. But to avoid the scams of cash applications it is essential to read the SMS.

Don’t respond to payment action-related SMS

When there is a call for action, the SMS with attractive offers and discounts may be a part of a trap. Responding to the call for action can result to lose money or sometimes can affect the account with malware functions.

Altogether, do not act to it as no application or bank will provide any attractive offers or discounts asking for any call for action.

Often clicking on the SMS or emails acts as a trap, there are about 14 million Users according to recent studies suffering due to it. Users receive money in their accounts without any track of the sender. It is alarming that requires alertness. Stay alert and always take immediate action against such unknown transactions.

Cash applications should always have a track of the transactions that are carried out by the users and the senders. Not any external unknown users, it is alarming.

Check the details closely

If any such doubtful and questionable situation arises, it is essential to study and check the detail closely. Phishing or disruptive attacks are easy to determine if closely checked about the details. Also, it will never ask for sign-in codes. Trusted accounts have the seal of verified or secured transactions.

Control of internet scams are difficult, as tracking the hackers is less likely possible. They are experts in programming and diverting their identity as well as address, known as hacking.

Parimatch Betting Company is one of the most famous online sports betting companies in India.…

The history of gambling spans thousands of years. Various kinds of gambling were chronicled in…

Gambling entertainment has attracted people since ancient civilizations. Today, the range of casino games is…

Photo by michael weir on Unsplash The country is an athletic and economic powerhouse and…

Irrespective of being men or women, both are found to spend good time in the…

Sports have always been a key part of life, and many have now taken it…