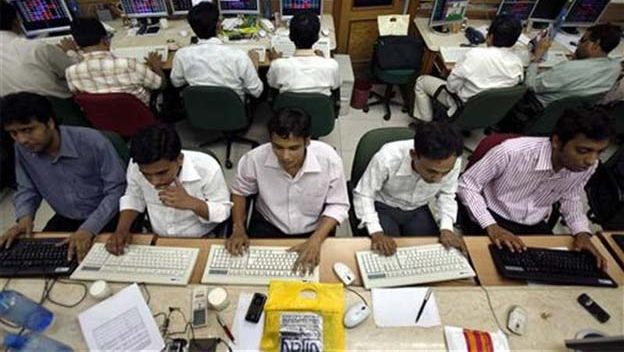

A benchmark index of Indian equities markets closed on Tuesday’s trade 352 points or 1.71 percent up, after the Reserve Bank of India (RBI) raised a key policy interest rate, while easing liquidity in the financial system.

A benchmark index of Indian equities markets closed on Tuesday’s trade 352 points or 1.71 percent up, after the Reserve Bank of India (RBI) raised a key policy interest rate, while easing liquidity in the financial system.

All the stocks were in green and the rally was led by banking index (bankex), auto, metal, healthcare and capital goods sectors.

The 30-scrip sensitive index (Sensex) of the S&P Bombay Stock Exchange (BSE), which opened at 20,593.49 points, closed the day’s trade at 20,922.70 points (provisionally), up 352.42 points or 1.71 percent from the previous day’s close at 20,570.28 points.

The Sensex touched a high of 20,952.55 points and a low of 20,493.66 points in intra-day trade.

The wider 50-scrip Nifty of the National Stock Exchange (NSE) also made healthy gains. It ended at 6,219.90 points (provisionally), up 118.80 points or 1.95 percent.

Healthy buying was observed in bank, automobile, metal, healthcare and capital goods sectors.

The S&P BSE Bank index was up 543.55 points, followed by automobile index, which gained 295.29 points, metal index was higher by 182.75 points, healthcare index was 145.25 points up and capital goods index closed the day’s trade 115.37 points up.

The surge in the market came after the RBI in its second quarter review of the monetary policy for 2013-14 hiked the repo rate by 25 basis points or 0.25 percent to 7.75 percent. Repurchase or repo rate is the rate of interest that banks pay when they borrow money from the central bank to meet their short-term funds requirement.

Taking a cue from the stability in the currency markets, the RBI rolled back some of the measures put in place to support the rupee. The Marginal Standing Facility (MSF) rate is reduced by 0.25 percent to 8.75 percent.

The move will ease liquidity in the banking system. MSF is a window for banks to borrow from the RBI.

-IANS