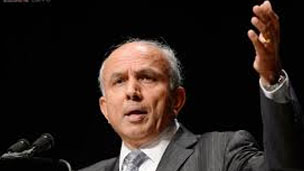

Hyderabad-born IITian Prem Watsa, who has come to the rescue of BlackBerry by injecting a $1 billion investment into the Canadian company, says an outright takeover bid would have been a mistake.

Hyderabad-born IITian Prem Watsa, who has come to the rescue of BlackBerry by injecting a $1 billion investment into the Canadian company, says an outright takeover bid would have been a mistake.

Watsa, who has been variously described as “Canada’s Warren Buffett”, and “billionaire king of lost causes”, told a Canadian newspaper that his Fairfax Financial Holdings abandoned the takeover bid after determining it was a mistake to saddle the company with high-yield debt under a planned leveraged buyout.

Instead Toronto-based Fairfax, which already holds a ten per cent majority share, and other institutional investors will invest in BlackBerry through a $1 billion private placement of convertible debentures with Fairfax putting in a quarter of the amount itself.

As part of the deal, Thorsten Heins is stepping down as chief executive officer and John S. Chen, former CEO of Sybase and Siemens, will serve as interim CEO and executive chair of BlackBerry’s board of directors.

Watsa, 61, chairman and CEO of Fairfax, who will be appointed Lead Director of the company on completion of the transaction in a couple of weeks, told Toronto Based Globe and Mail that he wants to build, not split up the company.

“We looked at it and said, ‘Hey, a high-debt situation was not appropriate,'” he was quoted as saying in an interview with the paper

That insight was gleaned by his advisers during a due diligence that began after the company tabled a conditional $4.7-billion takeover offer in late September, Watsa said.

“We wanted to take the ‘For Sale’ sign down, get John Chen as executive chairman as soon as we could and finance it for the long-term,” he said. “That’s effectively what we’ve done.”

Watsa told the Globe his financing plan is intended to offset a “cash burn” that is expected to last for the next four to six quarters, depleting the company’s $2.6-billion in cash and investments as of Aug 31, and acknowledged the uncertainty stemming from the sale process had hurt the company’s business.

“Why would you buy a BlackBerry system or a BlackBerry phone if you think the company is not going to survive? Well, that’s out. BlackBerry is here to stay,” he said, adding “There’s no question” the very public strategic review and uncertainty around it hurt the company’s business prospects.

Watsa, who quit the BlackBerry board in August as the company announced it was pursuing a strategic review, said Monday that cobbling together financing for the proposed $4.7-billion takeover “was not a problem.”

“We’ve, over 28 years, whenever we thought something was a good idea, been able to raise the money,” he was quoted as saying.

Watsa dismissed the market’s hostile reaction to the deal’s collapse, saying “I’ve been in the market 40 years. If you decide to make a judgment on what the market thinks for every half an hour, that would be very inappropriate.”

-IANS