As soon as the youngsters start earning they indulge themselves in worldly pleasures and when you asked them about their savings or investments they will give tell you how money is not enough for any kind of savings and how complex it is.

It is discovered that some youngsters when they start earning they love the bliss that money brings in that euphoric condition they tend to not engage in any serious investments.

Let’s have a look at some investment mistakes done by youngsters.

1.Do not Procrastinate- The early you invest, the more returns you earn.

Delay in investments is one of the major mistakes done by youngsters. Many youngsters wait for ‘right time’. They do not know the importance of early investments. According to one survey, one out of three investors waits for five years before their first investments. One has to take small but steady investments decisions. And the best part of starting early is that you can make mistakes and recover it and also you can maximum returns due to compound interest. So find and learn about investment ideas and act on it.

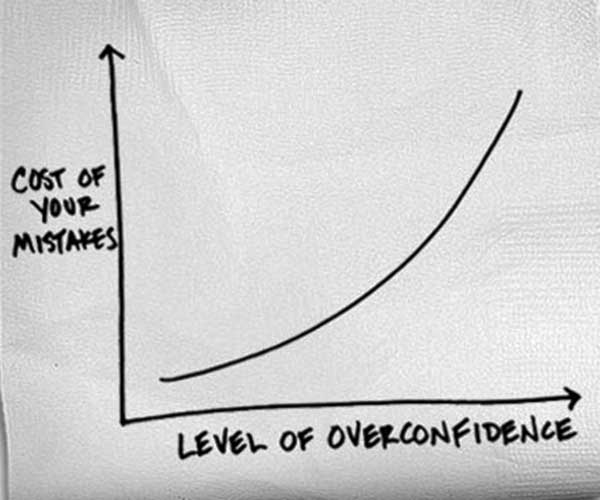

2. One Should Not Be Over Confident About Their Future.

One should not be over confident about their future incomes as growth and economy of country fluctuates. So instead of spending more, one should keep aside good chunk of money for slowdown period.

3. Thinking that investment is only for rich and senior people and not for youngsters.

If you think that you do not have extra money to invest or it’s only for rich guys can only take the risk of investments then investment will become a distant dream for you to become an investor. You can started off with small amount any time and slowly increase the percentage. This will imbibe the habit and you will have less risk ad returns as well.

4. No need to be a hawk eyed investor.

If you have well diversified portfolio then you do not have to constantly worry and keep a noose on business channels for market update, as this reduces the risk of loss.Proper diversified investment will aid you to concentrate on your work and hobbies as the daily fluctuations will not bring major losses. Some young investors have lot of worries and what if questions in mind as of course they do not want to lose their hard earned money. So invest at right time and at right place to have no worries.

5. One should not totally rely on others like parents and financial advisors.

It’s important to take advices from well experienced person but ultimately you have to take final call. Advisors will also tell you to learn in detail about the market and not to blindly put in money where he or she says.

Take advantage of your age and grow your savings by simply avoiding these grave mistakes that mostly young investors do.